Certification Programme

- Homepage

- Certification Programme

Are you ready to harness the power of health

I’m a health and lifestyle coach to smart (and busy!) women who want to look and feel their best, but who don’t have a ton of time to exercise, shop for speciality foods, or cook tons of meals every week.

Are you ready to harness the power of health

I’m a health and lifestyle coach to smart (and busy!) women who want to look and feel their best, but who don’t have a ton of time to exercise, shop for speciality foods, or cook tons of meals every week.

Nutrition Science

Anatomy / Physiology – Digestive, Circulatory & Respiratory Systems.Enzymatic Digestion

Dietetics Practical

Anatomy / Physiology – Digestive, Circulatory & Respiratory Systems.Enzymatic Digestion

Fitness Training

Anatomy / Physiology – Digestive, Circulatory & Respiratory Systems.Enzymatic Digestion

Children Nutrition

Anatomy / Physiology – Digestive, Circulatory & Respiratory Systems.Enzymatic Digestion

Food Scientist

Anatomy / Physiology – Digestive, Circulatory & Respiratory Systems.Enzymatic Digestion

Weight Management

Anatomy / Physiology – Digestive, Circulatory & Respiratory Systems.Enzymatic Digestion

Over 20 Years of Experience

Health Coaches look at exercise, eating, wellness, and food not just as calories and weight loss, but also on mental, physical, and spiritual terms.

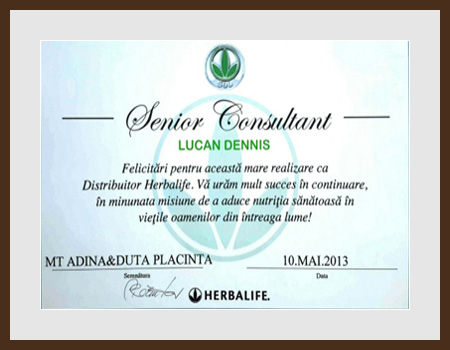

Our Certificates

Healthy eating is about getting the correct amount of nutrients – protein, fat, carbohydrates,

vitamins and minerals you need to maintain good health.